This is the biggest reason I haven’t moved. I managed to buy a house in a low cost of living area, with a low interest rate. Any move would force me to throw away my money renting, take a massive size/quality hit, or become house poor. And like them, I make about $250k.

I think your situation is a bit different. They are choosing not to relocate to a place where they can buy, because they tried that and thought it was boring. I am certainly not saying the housing market is fine, but these folks made a decision between buying a house and living in their preferred locale.

Personally, my family made the opposite choice two years ago, leaving the Best Coast and moving to the Midwest in large part so we could afford a house, which we did on less than $250k/yr gross. This locale is not our first choice, but our priorities were different from the priorities of the couple in the story. Money was not their only issue.

But fuck the housing crisis. We need policy changes that highly favor primary place of residence and disincentivize rental properties.

Wahhhhh. Only 250k?

He’s not complaining about his income. He’s saying “I’ve reached a level of income that SHOULD entitle me to the American dream, but even at this amount I too am barred”

When we say ‘eat the rich’ we don’t mean ‘shit on what is effectively what’s left of the middle class’.

Thank you. You’re spot on with my thoughts. I used to consider myself “upper middle class” with the mobility to do what I wanted. However if I’m having trouble, and I know what the median income is, I know for a fact it’s 100x worse for someone in that bracket. It’s just plain gotten out of control.

Honestly the measure of what I use for “are you rich?” Is “can I survive a long term medical issue (or any other “big” issue) without it causing an impact to my current quality of living?” and for 99%+ of this county that is no longer possible.

Yeah I don’t make nearly 250 but im surprised at how high a quartile I am considering how poorly I have to live. I totally realize how lucky I am and how sad that is.

Yup the answer for costs that look like years of medical debt and no functional income generation is gonna be old-yellering us starting in the next couple years

Maybe we can go to work camps first to get some last profit and call it some kind of final solution to ending the drain on society that the piors inflict on the strong morally superior income brackets

There’s another side of this though, which is that his “American dream” single family home should simply not exist in large numbers in the location he wants. It should be prohibitively expensive to own an entire acre in such areas, because that acre should house somewhere between a dozen or a few hundred people depending on the density. The attitude of “I want a single family home within walking distance of the subway” is ridiculous. If detached housing is your priority you should absolutely need to move farther out into the suburbs.

I literally live on 1,089 sq-ft of land… (for reference, 1 acre is 43,560 sq-ft)

I was shocked to find out that over 50% of millennials own their own homes.

I’d venture to say a big chunk of those folks inherited wealth. Most millennial homeowners I know inherited money from grandparents, aunts, uncles, and/or parents.

And like many who inherited wealth, these folks often make up their own little rags to riches story about how they got where they’re at.

Roughly 3% of Millennials have inherited money according to the findings in Northwestern Mutual’s 2024 Planning & Progress Study.

Misleading statistic. This doesn’t include parents/grandparents who buy houses and then put their kids name on the title. Nor does it include when parents pay for all their kids college expenses, or rent, or their cars… etc…

Yeah, my wife and I didn’t inherit any money or get any kind of gift for a down payment but we wouldn’t be homeowners unless our parents paid tens of thousands into each of our college educations.

My husband and I wouldn’t be homeowners if we didn’t live with my parents for over a decade saving up. Though I understand not everyone has that available to them.

If we’d had to rent an apartment it would’ve never happened. We also don’t have kids, so that’s a contributing factor too.

Even with all that, we could only afford a small, one story fixer upper that was an estate sale in the middle of nowhere. It’s a house though, and we were very lucky to get it.

Yeah for sure, a vast majority of people in the United States receive financial help from their family. 70% or so. Less than a third don’t.

Which I guess swings us back to the surprising fact that a broad majority of millennials can afford a home and a simple majority already own one. Just seems crazy.

I’m a millenial but not one of those people you’re describing, and I have actually paid my condo off.

The keys for me:

- No kids

- I job hopped in (what at least used to be) a high-paying field (tech)

- I moved job markets from a low COL (cost of living) market to a high COL market

- No student loan debt for me (my mommy and daddy paid for my tuition to a local state school 🫶 ), minimal student loan debt from my wife (~5k)…which I paid off after we got married

- I don’t give a shit about cars…I drove used cars until I could comfortably buy a new one cash

- We only have one car between the two of us

- I moved rather than paying higher rents, and I often lived in really crappy apartments because they were cheaper (I do not recommend btb)

Healthy helping of luck involved, and definitely support from my parents by way of room and board until I was like 23, tuition, small car loan of ~8k after I graduated. However, I paid them back in full for the car, and I’m the only one of my siblings not to hit up Mommy and Daddy regularly like an ATM. I fucking hate debt with a passion (or even really temporarily owing someone else anything) and have basically never carried large amounts of it outside of when I had my mortgage for my condo.

(My neuroticism around debt is probably why I paid off a historically low rate mortgage…if I would’ve sunk that into the stock market or something instead of paying it off I probably would’ve made a fortune.)

It’s not impossible to do without inheriting wealth. I put 20k down with my wife in 2018 and we didn’t inherit anything. We rented a very small house before that and now we are better off than the people this story is about.

I finished PhD in 2015, married in 2017, buy house 2018. My wife has a professional doctorate as well. We owe a shitload still, but it’s for like 2% interest so it isn’t that bad.

It’s not rags to riches, but it’s doing what you can do in the middle of the northernmost southern state and heavily investing in our white collar educations.

I must have missed the part where I said it’s impossible to do.

Did they though?

Many elderly end up being forced to sell their home and empty their retirements on nursing home costs. Leaving nothing to their descendants.

The ones that die at home or unexpectedly would be the ones that leave something behind in our capitalist wasteland.

I inherited about $10k when my dad died. It was enough for a 10% down home loan in 2013 (along with my savings). I’ll probably never move out of this house at this rate.

Yeah… Maybe this is one of the ways I should start associating myself with Gen Z but they also have higher home ownership than boomers did at this age cause apparently the covid fire sale left them still with their parents money and cheap houses.

I dunno I really don’t know how anyone does it but I have also been homeless 3 times since I started college so not really a great example.

I’m not sure I understand the math in this article. At current interest rates, a $550000 is closer to a 3.5k mortgage, not 5k.

At 250k a year, they’re making roughly 20k per month. If they’re willing to pay 30% of their income to a mortgage, that’s 6k. Even post-tax, that’s still more than 3.5k.

I agree that the cost of housing is ridiculous. This sounds more like they have exceptionally bad credit or they’re looking at homes that are way above their budget.

As someone who will have to dedicate 60-70% of their income to own a small, run down home, i really dont have a lot of sympathy for them. 30% of your income to housing is considered affordable, however that metric has likely been impossible for most people to reach over the past decade, most people can’t even rent for 30% of their income these days.

Im not supporting high housing and rent costs, i just think compared to average American right now, this couple shouldn’t really be considered “struggling” or “poor”

As someone living in Germany, what pissed me off most was when they mentioned that they never imagined raising their kids in an apartment. Like an apartment is beneath them. It is 2024. Don’t we all know that heating single family homes and the sheer extra space they require is absolutely disproportionate? Everyone wants a cheap huge single family house in the middle of the city and no cars and no climate change. Like, yeah, that won’t happen. Can we please start normalizing living in apartments? We just moved to a much cheaper city and hope to buy a 3-4 room apartment here one day. This will still cost us about 600k and we make less than 50k combined. But even if we had the money to pay over 1.5 mil for a house here, I wouldn’t want to live in a house, unless I’d have like 6 kids.

As your kids age into teens and young adults, the apartment offers more freedoms than suburbia as they wont require a car to go anywhere. In many US suburbs, kids are chained to their parents as a taxi service until they need to buy their own car. Which is why so many american suburbs have 4+ car sized driveways, because every human in the house must buy a car and gas and insurance etc.

Don’t worry, there are plenty of suburban apartments to get the worst of both worlds these days

America is secretly a nation of mech pilots but the mech has more rights than the person in it.

You know how hard it is to find a 4 bed apartment in the us? Most houses aren’t 4 bed!

Why would you need 4 bedrooms for a family of 4? I’m not 100% sure how rooms are counted there but wouldn’t 3 bedrooms and one living room be sufficient?

In my city, it is almost impossible to find a 3 BR apartment, let alone one without exorbitant condo fees. At that point, a 3 or 4 BR house is not much more and you own the land as well.

The problem is developers can make more building studios, 1, and 2 BRs, but anything beyond 2 BR the marginal return is lower. So if you have two kids, you’re probably going to want at least 3 BRs, which is so prohibitively expensive due to a supply shortage, the best option is to buy a house.

going to confirm. The easiest units to find are 2 bedroom, 3 bedroom are rare but not impossible to find and overpriced (you will pay almost double. To the point your wondering if you can get away with getting a 2 bedroom and a neighboring 1 bedroom because it might be the same). one bedroom and efficiency which they like to pawn off as studios (studios should have the space of a one bedroom without the wall) are common but bang for the buck 2 bedroom will get you the best price per square foot especially in relation to association dues.

Den or office? I mean really not a huge needed thing and I would happily just take a nook in a corner but some people need it?

Got to go old school and just put the office computer in the living room so everyone can enjoy the sounds of dial up

I think that’s the point? That even this couple who looks successful at a first glance still can’t meet the bar where a mortgage is financially responsible for them. America is struggling.

They could manage a mortgage at their income, they probably just aren’t satisified with what they can afford or have other lifestyle decisions eating too much of the budget.

20k a month? you think they pay 10k a year in taxes at 250k???

The 30% rule is generally about gross pay. Their gross income is about 20k a month.

Regardless though the 11k a month take home doesn’t make much sense. That would mean they’re paying closer to 100k in taxes plus another 20k on other deductions, which even on the west coast is absurd.

Not too weird if you consider pre-tax contributions for retirement and health insurance.

Regardless, this is some clickbait bullshit. I ran some numbers too like other commenters, and you have to have some real shit credit even with an 11% down payment to get the monthly payment cited in the article. Even so, with an 11% down payment you shouldn’t be buying a house anyway due to the PMI and higher interest that comes with it.

There’s a whole mess of poor financial decisions that led to the clickbait headline.

deleted by creator

Also, lots of people will jump to say that a $250k household income is middle class and I’ve seen a few in this thread, but I personally don’t know how anyone could arrive at that conclusion. Median household income in the US is more like $105k. A household income of $155k is enough to put you in the top 20%. $200k will put you in the top 12%. $250k gets you to the top 8%. When 92% of people are able to make do with less, it really just seems like people such as the ones in the article don’t understand what it is to live within their means and don’t understand how much better off they are than most everyone else.

Middle class is a very arbitrary term. But if you expect it to be defined by something close to median income as the starting point, then that’s setting the bar very low. The lifestyle of a household making gross 250k and 100k isn’t drastically different. The big differences would be that the higher income household will have a little more options for children, daycare, education, retirement, or a couple more vacations per year. The lower income family would be doing any of those tasks at the expense of another. And even the 250k household will not effectively be able to check all the boxes off. One is going to be much more comfortable, but they will likely be working comparable hours to do it. Nothing about that screams rich. Instead of saying that people making that much aren’t middle class, we should steer the focus to how low the median income is.

Assuming your numbers are correct, if going from 155k to 250k moves you from top 20% to top 8%, that really just shows off how income is heavily skewed towards that top 0.001% more than anything since the slope beyond 1% is nearly a straight line up. I’ve more than doubled my income over the last 10 years and am making over $150k now, but I live the same life I have 10 years ago with a little more breathing room and realization I can actually retire. To me, it’s less about what I gained making more money. It’s about how little I had when I started around $40k. I have friends who make about half of my salary but arguably have a more lavish lifestyle and own nicer things. They sacrifice retirement for that choice. I still sacrifice living in a home at my income because I’m choosing saving for retirement over raising a family. My coworkers who make more than me have families and a house and their math doesn’t have a comfortable retirement on the table. It’s just that expensive.

All this middle class labelling serves is to drive this artificial resentment towards people of similar financial working class against relatively small margins. The couple in the article listed out very simple goals for what their housing costs should be and have struggles to stay in that budget. It speaks volumes to the housing issue we have today but also the expectations for what housing is. It’s going to be difficult to visualize a world where everyone can get that picturesque house with property and a coupe cars without some serious growth in development. But the only way to do that is through making terrible choices in city planning.

Housing should be affordable, but the idea that every family can own a big house just feels like a carrot on a stick that isn’t attainable within today’s parameters.

Thank you for doing the math on this. I ran the numbers through an amortization schedule and was scratching my head when they said they couldn’t afford a $550,000 mortgage because it was $5k a month. For being a financial analyst, she’s not very good at basic finance.

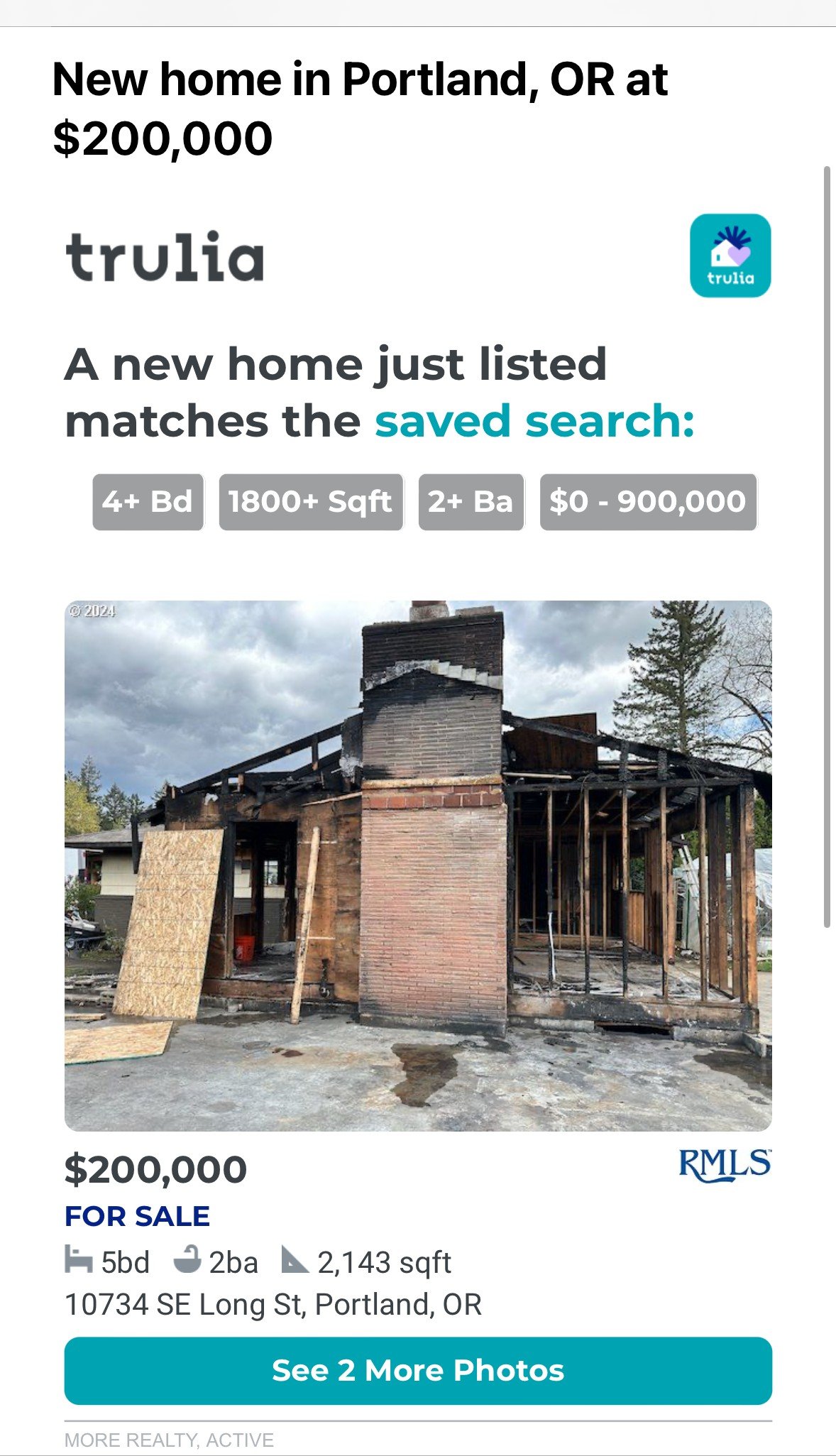

I’ve been house browsing in the Portland area for a couple years and am losing hope of ever being able to afford one. Last year I saw a frame of a house, basically a roof on studs with tarp and plywood as the “walls” being listed for sale. They were asking for $300k.

As someone who lives here:

This is real.

It has the audacity to include that listing as “a new home”.

Wow.

A 5 bedroom, 2 bath with so much natural light! What a steal!

Seems cheap for land. You must be in a low cost area. I’m reading your post as $300k for a buildable lot in a major city.

Last time I renewed my homeowners insurance, they put full replacement value of my house under $200k, despite the tiny plot of land and overall purchase price being several times that. I wish my town outside Boston had a buildable lot for only $300k, but the reality is much worse and the house itself is only a fraction of the value

It all seems beyond insane to me considering that records show houses in my modest, outer-city neighborhood were selling for around $50k in the early 2000s that now have a market value of over $800k.

If you own a vehicle maybe venture out of the city a little ways. Bonus points if there is any type of public transportation to take you to the city.

No, I’ve lived in suburbs for much of my adult life and I have no interest in that lifestyle. Much like the family in the article, I make enough to rent in the city. But it sucks knowing that living where I want to be comes at the cost of spending the money I could be using to invest in my community and improve the home I’m living in instead to line the pockets of somebody who was either lucky enough to own the land before property hyperinflation or wealthy enough to purchase it after the fact.

If the house goes for a million an investor could buy it up build a new house for half a mil sell it for 1 mil and profit 200k…

It’s crazy.

These stories are always bullshit. They can’t afford a 3000sqft single family home on an acre inside the beltway of a HCOL city. Anyone making $250k can easily afford a condo or townhome anywhere in the US. If you really need useless interior volume or wasteful yard space then you can move farther out and afford that.

Wasteful yard space? Do you enjoy playing Frisbee buddy? How about just running around with your kids.

What is a public park?

In a lot of neighborhoods in the US, you have to cross major, high-traffic streets to get to a fairly small public park.

Then that is less of a city and more dystopian urban sprawl pretending to be a city.

That pretty accurately describes pretty much every U.S. city that isn’t directly on the East Coast, yeah. And even a few that are.

Do you suppose a yard is an option in those same areas?

Yes. I live in one such area, in a city of many of them.

So it’s in a major city that also has heavy traffic, but also enough space for houses with spacious yards?

That’s why it has traffic, because it was built for low density.

A place full of junkies?

But seriously, as an introvert:

I hate public parks

I have a 65 acre park a block away.

Lucky you. Wish we all was as fortunate.

The entire point is that urbanization permits the kind of development patterns which expands access to larger public green spaces, rather than wasting space on individual yards. Then everyone has access to recreational areas which are not only more sustainable and efficient, but which also act as gathering points for the local community, helping to prevent exact the kind of harmful isolation which makes the suburbs notoriously depressing.

God I love frisbee. I miss when I was young and had friends who enjoyed it. I have two frisbees in the trunk of my car just begging to be flung across a wide-open space. I’m gonna bug my partner and make her indulge me a bit this weekend.

Out of curiosity I checked how much a 3000 sq ft home on 1 acre lot is in my area. The only thing under $4m was a $2.4m fixer-upper.

Rough math after maxing 2 401ks, taxes and paying 1000 a month for insurance they should be making around 12k take home a month. Even with only 5% down they should be able to get into a 7-800k house and still have 4k-5k a month for other expenses. I found 25 results under 700k in the greater Portland area some as low as 479k (actually in Portland) for 2.5k sf min 4+ bedrooms 2 bath min 1/4 acre lot.

I’m in Canada. The outskirts of Miami are exactly the same price as Swift Current, Saskatchewan. 300 grand American or 400 Canadian. Exact same, except the canadian housing market is so fucked that a place in the literal center of buttfuck nowhere everyone is depressed suicide rate 27x national average…is Miami priced.

Tbf Miami is in Florida

You forgot a likely $1000 a month in after tax student loan payments.

I beg you to show me what you can find in the Portland OR area for 250K. Even if you look outside about an hours drive there isn’t much. The best I could find was a 2 Bed 2 Bath with about 1000 sq/f. https://www.zillow.com/homedetails/7545-N-Olin-Ave-201-Portland-OR-97203/350854324_zpid/

Please don’t disparage others situations or minimize a situation because you have the benefit of living in a place you can afford with a job that lets you live there.

deleted by creator

deleted by creator

I totally get how they feel.

I got lucky with some investments I made in 2020 that appreciated post-covid and was able to pay off my student loans and put a down-payment on a condo.

If you’re a wage earner, at least here in the US, the prevailing political thought seems to be that it’s perfectly acceptable for you to live on gruel in your grossly expensive rented apartment. I wish I could hope that voting changed anything about that, but I don’t think it matters who we elect anymore, at least beyond the local level.

Seriously.

I realize, daily, that I’ve very much lucked my way into my station in life. Two kids, a 4bed/1.5 bath house in the suburbs. Decent steady job. 200k household gross income.

My house is “worth” a half a million dollars. At least. But so is any other house that is maybe a sidestep. There is no moving to another town…we can’t manage to accumulate any significant savings before something happens to take it all away. Even if we could swing the cash necessary to start buying a house, we were able to refi during the pandemic…so moving to a similar-priced house now will mean a significantly higher mortgage due to the higher interest.

I’m on the other end of the spectrum for the most part. I was born into a huge family and actually started my adult life 3k in the hole (on top of those student loans) because I let my parents use a credit card in my name which they didn’t pay back, but yeah, I’ve been lucky in a big way these last several years.

I have everything I need and some of what I want, and in today’s America, that’s as close as you get to the American dream if you’re not born wealthy in the first place.

Over the past three years, the couple, who are both 36 and live in a suburb of Portland, Oregon, have been looking for a home.

Yeah, it be like that here. Most houses are costing around 1,000,000 in the Portland area due to wealthy techbros moving from San Fran.

Sure, but it’s also harder to have that pay in areas that don’t charge that much. It’s like real estate keeps rising prices right until it uses up almost all your money…

There’s also a trend of hedge funds purchasing land and homes with the sole purpose of renting or using them as Airbnb’s as a method of “investing”.

Renting for life, this is exactly what the landowning class, much of whom are now giant hedge funds that have been soaking up houses and properties for cash on the barrel head, in this country want.

We desperately need national legislation to put an end to people and corporations owning large swaths of homes in this country otherwise we will end up with fiefdoms and are in danger of returning to a world of medieval nobility in land ownership.

didn’t they get the memo: houses are for the 1% now. 250K might sound like

a lotenough, but you’re still a peasant to the people who own youYou raise a great point.

To the Owning Class, those working for money are nothing and replaceable. Rise up with the poor.

As I mentioned elsewhere, over half of millennials own their own home. So it’s more like houses are for the 53%, but I take your point.

is that statistic own their house outright or have a mortgage that once they pay off, if they pay it off, will then own it. Either way Im amazed its 50% but remember in 2008 mortgage rates were about 6%

The 2008 housing crash gave many genX/ older millennials a brief window of opportunity to purchase a home.

My wife and I purchase our first home in 2009. Every home was a foreclosure that we looked at. 90% of them were investors/flippers who got caught with their pants down. The home we purchased had been sold 2 years previously for almost 2.5x the price.

Between refinancing at low interest rates and a largish initial down payment from the sale of the first home, my current mortgage is the same as my rent for a 3 bedroom duplex in 2005.

At the it’s current estimated value and interest rates, my wife and I would barely be able to purchase the home we live in today with our income. We make 2.5x more than we did when we bought it

The majority of all homeowners have a mortgage.

Yeah, mortgage rates are definitely higher now. 30 year fixed rates are around 7%, if your credit score is around 700. Still around 6% with high credit scores.

Bringing in 17k+ per month after tax and cannot afford a home?? I call bullshit. A $750k home is 5k per month including HOA/tax/insurance. That’s less than 30% of their take home.

They could double their payment and pay it off in 5 years, with 7k per month to live on, then they live rent free for the rest of their lives.

This article feels like propaganda. Homes are over priced but 250k per year is a lot of money.

They want to keep their monthly mortgage payment between $3,000 and $3,500 — or around 30% of their monthly take-home income of about $11,000.

This makes it seem like they only take home a little more than half their wages.

Something doesn’t add up. The only issue I see is one might be an independent contractor. Or they’re excluding health insurance and 401k.

Edit: some quick digging. First issue is the definition of take home pay.

Take-home pay is the net amount of income received after the deduction of taxes, benefits, and voluntary contributions from a paycheck. It is the difference resulting from the subtraction of all deductions from gross income. Deductions include federal, state and local income tax, Social Security and Medicare contributions, retirement account contributions, and medical, dental and other insurance premiums. The net amount or take-home pay is what the employee receives.

But the bigger issue is the 30% rule. 30% is on gross and not take home. This would give them a out 7k per month. I bet they’re following the advice of someone like a Dave Ramsey. These people are not victims.

It’s Business Insider, always read whatever they say with spoonfuls of salt

Well, they are saying they bring home $11k, not $17k a month, not sure where you got that number. With $11k of income, spending $5k on mortgage is less appealing. Especially if you consider a risk of layoff.

The headline says they make 250k, or around 21k gross. 17k was my estimate of net. Article doesn’t match the headline.

Not to mention savings, retirement, saving for your kid’s college, paying for their school (depending on whether or not the public system is good or not where they live), car payments, medical bills, student loans…

Don’t know what OP is smoking, but nothing he says makes sense.

I guess I’m lucky that I don’t get bored easily because I can afford a house quite easily since I don’t have to live somewhere “fun.”

With “fun” do you mean places where there are jobs?

Or maybe where their friends and family live? Where their kids have friends and support groups? Maybe where they’ve lived much of their life and don’t want to leave?

The previous poster is just making shit up so they can cast shade. It’s sad, really.

Yes, my own lived experience of not needing or wanting things people desire in cities is clearly something I made up.

I suspect you’re just deflecting now as that’s not what your comment communicated or suggested. You said they’re making their decision to stay in Portland because they want to live somewhere fun, something that isn’t even suggested in the article.

When you make a statement with no evidence to support it, it’s often referred to as “making shit up”. If you can cite a reference in the article that explicitly states that they’re staying in Portland because they want “fun”, I’ll eat my words and issue a public apology (edit: as a post, not a comment, on .world for all to see.)

No, I said I’m glad I don’t need the “fun” that people keep telling me is why people choose to live in cities. But if you want a citation, here’s a quote from the article:

“We actually tried uprooting the kids to a more affordable town and found ourselves less happy in the end,” Laura said.

So maybe not “fun” but definitely happiness, which is fun adjacent.

I work from home. Everywhere has a job.

But, no, these folks weren’t complaining about jobs. They were complaining about not having stuff to do.

I work from home. Everywhere has a job.

Someone here clearly hasn’t checked their privilege or even just thought about it.

But, no, these folks weren’t complaining about jobs. They were complaining about not having stuff to do.

If you actually read the article, you’ll see this is also just made up.

I’m posting this in my underwear while getting paid. I know I have priviliege.

But so do the folks in the article:

When they’re not at camp, she says, the kids stay home with her while she works remotely.

But so do the folks in the article (also have privilege):

And that is relevant to my comment how?

Because you said I was privileged because I could work from home, but the woman in the article works from home. Why couldn’t she do that in Spokane?

Do you realize how hard you deflect or is your normal MO just a constant red herring fishing expedition?

I’m going to break this down in summary for the audience, then I’m disengaging to preserve my mental health.

You: these people just want to live in Portland because it’s fun. They should move. Jobs are everywhere. I work from home.

Me: that’s an awfully privileged thing to say (as in, jobs aren’t everywhere for everyone and not everyone can work from home, including the electrician husband in the article).

You: The woman in the article is privileged too.

Me: what does that matter?

You: she could work from home like me.

Like any of that has any bearing on anything. You’re just stretching hard to justify being judgmental and are cranking out bad faith arguments to support that.

Having things to do is important to some of us.

Also the fact that you work from home doesn’t mean that you won’t need to find another job later, and then your “stuff to do” might become a multi-hour commute to the new workplace.

I will never go back into an office and, thankfully, I have a role in an industry where they won’t make me. And if they try I can always just go back to freelancing.

I work from home don’t assume I will be able to forever.

I’ve been fully remote for the last six years, through two jobs. Prior to that I was 80% remote for five years.

I will not be taking a job that forces me to be in an office, and I’m in a segment of my industry where WFH is going to stick around for a long time.

They sound like the kind of couple whose phones beep all day with social media bollocks because they can’t bear to not feel a dopamine hit for ten seconds.

Location location location. Gotta expand your horizons.